By Bonddad

bonddad@prodigey.net

From Investor's Business Daily (subscription only):

The dollar last week sank to a 26-year low against the British pound and is nearing record lows vs. the euro. Even the lowly Japanese yen has gained some ground against the greenback.

Analysts say the dollar's fall is the result of a cyclical shift in the global economy: Growth and interest rates in Europe and Asia are outpacing those in America, drawing capital away from U.S. stocks, bonds and other assets.

"There are reasons to be bullish about other currencies, and that's why people are moving out of the U.S. dollar," said David Watt, senior foreign exchange strategist at RBC Capital Markets.

There are numerous reasons for the dollars decline.

1.) While the trade deficit appears to be moderating, it is still at high levels. Here is a chart from the Blog Calculated Risk. The lowest line is the overall trade deficit. The middle line represents oil imports and the top line represents oil imports only. Currency traders are selling the dollar partly because the US consumes more than it makes (which the trade deficit represents).

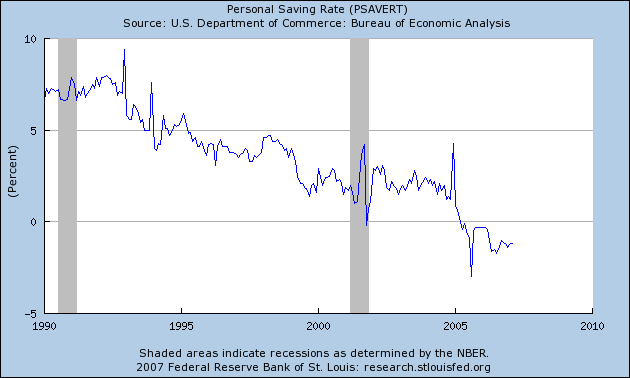

2.) The US savings rate is still negative, indicating the trade deficit must be financed from abroad. So long as the US economy has to have international financing to pay its bills, traders will lose confidence in the dollar.

To finance the trade deficit, the US and its trading partners are engaged in an "economic merry-go-round:"

But another baby step of a 27-basis-point rate increase will do little to cool the steamy Chinese economy or markets. To prevent a faster rise in its currency, the Chinese monetary authorities had to buy a staggering $136 billion in the first quarter alone, bringing China's foreign-exchange reserves to $1.2 trillion.

To buy up greenbacks, the PBOC "prints" yuan, colloquially speaking. The dollars are invested primarily in Treasuries and U.S. agency securities, with the salubrious effect of financing the U.S. budget and current-account deficits, in turn bolstering the dollar and holding down U.S. interest rates.

That this dollar merry-go-round cannot go on forever is at the core of the dollar bears' argument. The massive U.S. current-account deficit has to be funded, either through these political contrivances or capital inflows.

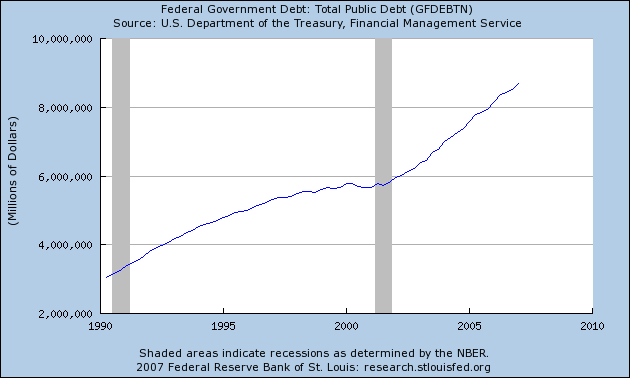

3.) The US Federal Deficit is far from "under control". The figures reported in the press (and by the Bush administration) include the Social Security surplus. Unfortunately, the US government is spending this money now instead of actually saving it (even US politicians have no idea how to save). This means the US will eventually have to pay all this debt back, which means we will have fiscal problems going forward.

4.) Other countries rate of growth is increasing. According to the International Monetary Funds World Economic Outlook, the rest of the world's growth is doing pretty well. That means other currencies are more attractive.

5.) While US interest rates are still some of the best around, other countries/regions are starting to raise their rates for various reasons. As the IBD article noted:

The European Central Bank and policymakers in China and Japan also are leaning toward rate hikes amid relatively robust growth and expectations of higher inflation.

Meanwhile, the Federal Reserve is likely to stay on hold for the foreseeable future. Policymakers are betting that subpar growth will cool inflation, which is still above the Fed's 1%-2% comfort zone.

The EU has raised rates over the last year or so, and Japan actually has interest rates above 0% (they stand at .5% now). While Japan still has a long way to go before they reach parity with the US, their announcement a few months ago to raise interest rates sent a shock through the financial markets as it signaled the carry-trade (borrowing in Japan and lending anywhere else) was no longer a given (the chart is from Barron's).

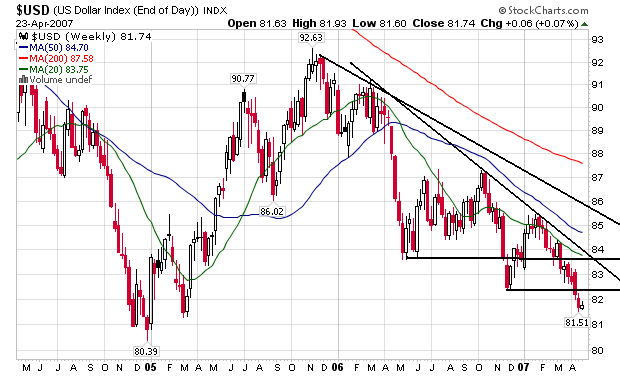

6.) The actual chart of the dollar has nothing but bearish implications. Note the following:

-- The overall trend is clearly down

-- The 20, 50 and 200 day simple moving averages are all heading lower

-- The overall index is trading below the moving averages, meaning price action will continue to pull the moving averages lower.

The conclusion from all this? There is no news that is dollar bullish and plenty of news that is dollar bearish.

For economic commentary and analysis, go to the Bonddad blog

No comments:

Post a Comment