Related

CBS Marketwatch: Gold Hits 5-wk. High on Dollar Slide, Trade Tensions---

April 10, 2007

By Mike Whitney“Of all the contrivances for cheating the laboring classes of mankind, none has been more effective than that which deludes them with paper money.” Daniel Webster

The American people are in La-la land. If they had any idea of what the Federal Reserve was up to they’d be out on the streets waving fists and pitchforks. Instead, we go our business like nothing is wrong.

Are we really that stupid?

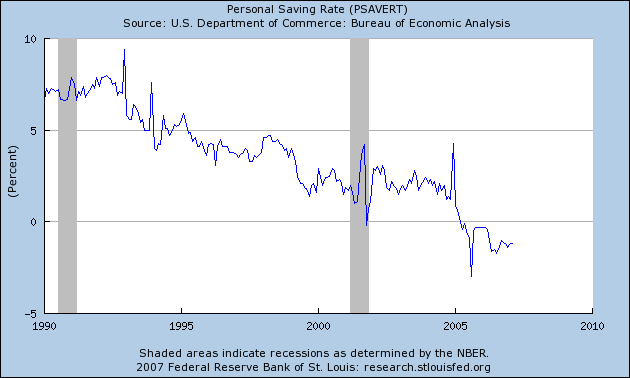

What is it that people don’t understand about the trade deficit? It’s not rocket science. The Current Account Deficit is over $800 billion a year. That means that we are spending more than we are making and savaging the dollar in the process. Presently, we need more than $2 billion of foreign investment per day just to keep the wheels from coming off the cart.

Everyone agrees that the current trade imbalances are unsustainable and will probably trigger major economic disruptions that will thrust us towards a global recession. Still, Washington and the Fed stubbornly resist any change in policy that might reduce over-consumption or reverse present trends.

It’s madness.

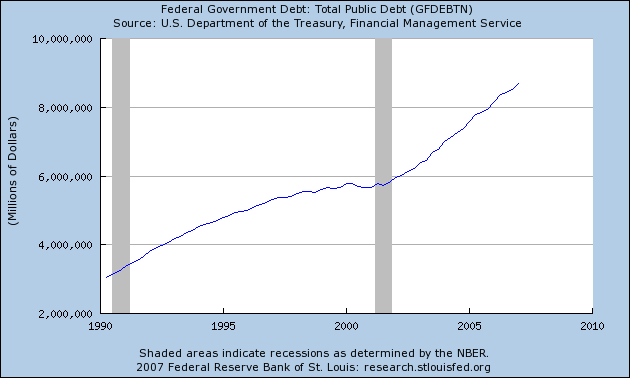

The investor class loves big deficits because they provide cheap credit for Bush’s lavish tax cuts and war. The recycling of dollars into US Treasuries and dollar-based securities is a neat way of covering government expenses and propping up the stock market with foreign cash. It’s a “win-win” situation for political elites and Wall Street. For the rest of us it’s a dead-loss.

The trade deficit puts downward pressure on the dollar and acts as a hidden tax. In fact, that’s what it is--a tax! Every day the deficit grows, more money is stolen from the retirements and life savings of working class Americans. It’s an inflation bombshell obscured by the bland rhetoric of “free markets” and deregulation.

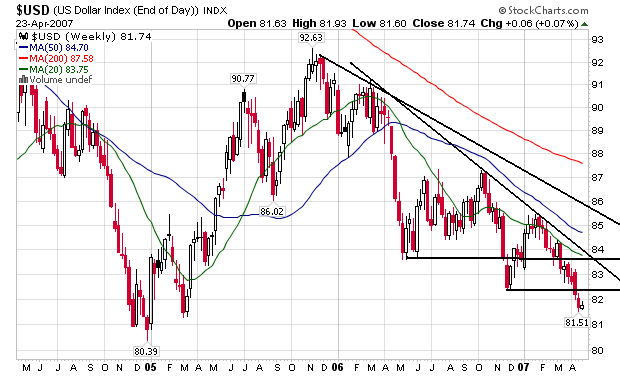

Consider this: In 2002 the euro was $.87 on the dollar. Last Friday (4-6-07) it closed at $1.34-- a better than 50% gain for the euro in just 4 years. The same is true of gold. In April 2000, gold was selling for $279 per ounce. Last Friday, at the close of the market it skyrocketed to $679.50---more than double the price.

Gold isn’t going up; it’s simply a meter on the waning value of the dollar. The reality is that the dollar is tanking big-time, and the main culprit is the widening trade deficit.

The demolition of the dollar isn’t accidental. It’s part of a plan to shift wealth from one class to another and concentrate political power in the hands of a permanent ruling elite. There’s nothing particularly new about this and Bush and Greenspan have done nothing to conceal what they are doing. The massive expansion of the Federal government, the unfunded tax cuts, the low interest rates and the steep increases in the money supply have all been carried out in full-view of the American people. Nothing has been hidden. Neither the administration nor the Fed seem to care whether or not we know that we’re getting screwed --it’s just our tough luck. What they care about is the $3 trillion in wealth that has been transferred from wage slaves and pensioners to brandy-drooling plutocrats like Greenspan and his n’er-do-well friend, Bush.

These policies have had a devastating effect on the dollar which has been slumping since Bush took office in 2000. Now that foreign purchases of US debt are dropping off, the greenback could plunge to even greater depths. There’s really no way of knowing how far the dollar will fall.

That puts us at a crossroads. We are so utterly dependent on the “charity of strangers” (foreign investment) that a 9% blip in the Chinese stock market (or even a .25 basis point up-tick in the yen) sends Wall Street into a downward spiral. As the housing market continues to unwind, the stock market (which is loaded with collateralized mortgage debt) will naturally edge lower and foreign investment in US Treasuries and securities will dry up. That’ll be doomsday for the greenback as central banks across the planet will try to unload their stockpiles of dollars for gold or foreign currencies.

That day appears to be quickly approaching as the 3 powerhouse economies are overheating and need to raise interest rates to stifle inflation. This will make their bonds and currencies all the more attractive for foreign investment; diverting much needed credit from American markets.

Just imagine the effect on the already-hobbled housing market if interest rates were suddenly to climb higher to maintain the flow of foreign capital?

The ECB (European Central Bank), Japan and China are all cooperating in an effort to “gradually” deflate the dollar while minimizing its effects on the world economy. In fact, China even waited until the markets had closed on Good Friday to announce another interest rate increase. Clearly, the Chinese are trying to avoid a repeat of the 400 point one-day bloodbath on Wall Street in late February ‘07.

Japan has also tried to keep a lid on interest rates (and allowed the carry trade to persist) even though commercial property in Tokyo is “red hot” and liable to spark a ruinous cycle of speculation.

But how long can these booming economies avoid the interest rate hikes that are needed for curbing inflation in their own countries? The problem is, of course, that by fighting inflation at home they will ignite inflation in the US. In other words, by strengthening their own currencies they weaken the dollar--it’s unavoidable.

This is bound to hurt consumer spending in the US which will ripple through the entire global economy.

The problems presented by the falling dollar can’t be resolved by micromanaging or jawboning. In truth, there’s no more chance of a “soft landing” for the dollar than there is for the over-bloated real estate market. Greenspan’s bubble economy is headed for disaster and there’s not much that anyone can do to lessen the damage. As housing prices fall and homeowners are no longer able to tap into their equity, consumer spending will slow, the economy will shrink and the Fed will be forced to lower interest rates.

Unfortunately, at that point, lowering rates won’t be enough. Interest rates need at least 6 months to take hold and, by then, the steady drumbeat of foreclosures and falling real estate prices will have soured the public on an entire “asset class” for years to come. Many will see their life savings dribble away month by month as prices continue to nose-dive and equity vanishes into the ether. These are the real victims of Greenspan’s low interest rate swindle.

The Federal Reserve is fully aware of the harm they have inflicted with their low interest rate boondoggle. In a 2006 statement the Fed even acknowledged that they knew that trillions of dollars in speculation was being funneled into the real estate market:

"Like other asset prices, house prices are influenced by interest rates, and in some countries, the housing market is a key channel of monetary policy transmission."

“Monetary transmission” indeed?!? Trillions of dollars in mortgages were issued to people who have no chance of paying them back. It was a shameless scam. Still, the policy persisted in a desperate attempt to keep the US economy from collapsing into recession. The upshot of this misguided policy was “the largest equity bubble in history” which now threatens America’s economic solvency.

Author Benjamin Wallace commented on the Fed’s activities in an article in the Atlantic Monthly, “There Goes the Neighborhood: Why home prices are about to plummet—and take the recovery with them”:

"Let's assume for a moment that enough people get fooled, and the refinancing boom gets extended for another year. Then what? The real problem hits. Because if you think Greenspan's being cagey on refinancing, the truth he's really avoiding talking about is that we're in the midst of a huge housing bubble, on a scale only seen once before since the Depression. Worse, the inflated housing market is now in an historically unique position, as the motor of the rest of the economy. Within the next year or two, that bubble is likely to burst, and when it does, it very well may take the American economy down with it."

Or this from Robert Shiller in his “Irrational Exuberance”:

"People in much of the world are still overconfident that the stock market, and in many places the housing market, will do extremely well, and this overconfidence can lead to instability. Significant further rises in these markets could lead, eventually, to even more significant declines. The bad outcome could be that eventual declines would result in a substantial increase in the rate of personal bankruptcies, which could lead to a secondary string of bankruptcies of financial institutions as well. Another long-run consequence could be a decline in consumer and business confidence, and another, possibly worldwide, recession”.

If it is not handled properly, the housing collapse could result in another Great Depression. America no longer has the (manufacturing) capacity to work its way out of a deep recession. While the Fed was sluicing $11 trillion into the real estate market via low interest loans; America’s manufacturing sector was being carted off to China and India in the name of globalization. Without capital investment and increased factory production, economic recovery will be difficult if not impossible. The so-called “rebound” from the 2001 recession was due to artificially low interest rates and easy credit which inflated the housing market. It had nothing to do with increases in productivity, exports, or paying off old debts. In other words, the “recovery” was not real wealth creation but simply credit expansion. There’s a vast chasm between “productivity” and “consumption” although Greenspan never seemed to grasp the difference.

A penny borrowed is not the same as a penny earned—although both may cause a slight bump in GDP. Greenspan’s attitude was aptly summarized by The Daily Reckoning’s Addison Wiggin who said, “GDP measures debt-fueled consumption--it really only measures the rate at which America is going broke”.

Bingo.

America’s biggest export is its fiat-currency which foreigners are increasingly hesitant to accept.

Can you blame them?

They have begun to figure out that we have no way of repaying them and that the “full faith and credit” of the United States is about as reliable as a Ken Lay-managed 401-K retirement plan.

The fragility of the US economy will become more apparent as Greenspan’s housing bubble continues to lose air and consumer spending remains flat. As we noted earlier, home equity withdrawals are drying up which will slow growth and discourage foreign investment. The meltdown in subprime loans has drawn more attention to the maneuverings of the banks and mortgage lenders and many people are getting a clearer understanding of the Federal Reserve’s role in creating this economy-busting monster-bubble.

The 10% to 20% yearly increases in property values are unprecedented. They are “pure bubble” and have nothing to do with increases in wages, demand, productivity, capital investment or GDP. It was all “froth” generated by the world’s greatest Frothmeister, Alan Greenspan.

As Addison Wiggin notes, “There is only one real source of wealth: a healthy and competitive environment involving the exchange of goods coupled with control over deficit spending.”

Elites at the Federal Reserve and in the Bush administration have steered us away from this “tried and true” course and put us on the path to debt and catastrophe. It won’t be easy to restore our manufacturing base and compete again in the open market, but it must be done. Strong economies require that their people produce things that other people want. This is a fundamental truism that has been lost in the smoke and mirrors of Greenspan’s shenanigans at the Fed.

Regrettably, we are probably facing a decades-long economic downturn in which the dollar will weaken, stocks will fall, GDP will shrivel, and traditional standards of living will decline.

The trend-lines in the real estate market will most likely be the inverse of what they have been for the last 10 years. This will dramatically affect consumer spending (70% of GDP) and put additional pressure on the dollar.

The dollar is already in big trouble--the only thing keeping it afloat is foreign purchases of US debt by creditors who don’t want to be left holding trillions in worthless paper.(US debt is Japan’s single greatest asset!) These “net inflows” have created a false demand for the dollar which will inevitably dissipate as central banks continue to diversify.

Last week the IMF issued a warning that there would have to be a “substantial” decline in the dollar to bring the trade deficit to sustainable levels. That, of course, is the intention of the Fed and Team Bush—to reduce the debt-load by deflating the currency. It’s a crazy idea. No one destroys the buying power of their currency to pay off their debts. It just illustrates the recklessness of the people in charge.

Also, on March 20, 2007 the Governor of China’s Central Bank Zhou Xiaochuan announced “that China will not accumulate more foreign reserves and will cut a small amount of current reserves for the formulation of a new currency agency”. Zhou’s statement is a hammer-blow to the dollar. The US needs roughly $70 billion in foreign investment per month to cover its current trade deficit. China is one of the largest purchasers of US debt. If China diversifies, then the dollar will fall and the aftershocks will ripple through markets across the world.

The Chinese are very careful about how they word their economic statements. That’s why we should take Zhou’s comments seriously. Three weeks ago he issued an equally ominous statement saying, “China will diversify its $1 trillion foreign exchange reserves, the largest in the world, across different currencies and investment instruments, including in emerging markets.” (Reuters)

This should have been a red flag for currency traders, but the media buried the story and the markets dutifully shrugged it off. The truth is that our relationship with the Chinese is changing very quickly and the days of cheap credit and a “high-flying” dollar are coming to an end.

70% of China’s currency reserves are in US dollars. The effect of “diversification” will be devastating for the US economy. It increases the likelihood of hyperinflation at the same time the housing market is in its steepest decline in 80 years. When currency crises arise at the same time as economic crises; the problems are much more difficult to resolve.

Doomsday for the Greenback

It is impossible to fully anticipate the effects of the falling dollar. The dollar is a currency unlike any other and it is the cornerstone of American power—political, economic and military. As the internationally-accepted reserve currency, it allows the Federal Reserve to control the global economic system by creating credit out of “thin air” and using fiat-scrip in the purchase of valuable manufactured goods and resources. This puts an unelected body of private bankers in charge of setting interest rates which directly affect the entire world.

Iraq has proven that the US military can no longer enforce dollar-hegemony through force of arms. New alliances are forming that are reshaping the geopolitical landscape and signal the emergence of a multi-polar world. The decline of the superpower-model can be directly attributed to the denominating of vital resources and commodities in foreign currencies. America is simply losing its grip on the sources of energy upon which all industrial economies depend. Iraq is the tipping point for America’s global dominance.

When foreign central banks abandon the greenback the present system will unwind and the “unitary” model of world order will abruptly end.

This may be a painful experience for Americans who will undoubtedly see a sharp fall in current living standards. But it also presents an opportunity to disband the Federal Reserve and restore control of the nation’s currency to the people’s legitimate representatives in the US Congress.

This is the first step towards removing the cabal of powerbrokers in both political parties who solely represent the narrow ambitions of private interests.

The War on Terror is a public relations ploy that is intended to disguise the use of military and covert operations to secure dwindling resources to maintain dollar supremacy. It is a futile attempt to control the rise of China, India, Russia and the developing world while preserving the authority of western white elites.

The strength of the euro portends increasing competition for the dollar and a steady decline in America’s influence around the world. This should be seen as a positive development. Greater parity between the currencies suggests greater balance between the states--hence, more democracy. Again, the superpower model has only increased terrorism, militarism, human rights violations and war. By any objective standard, Washington has been a poor steward of global security.

The falling dollar also suggests growing political upheaval at home brought on by economic distress. We should welcome this. America needs to remake itself—to recommit to its original principles of personal freedom, civil liberties and social justice--to reject the demagoguery and warmongering of the Bush regime—to reestablish our belief in habeas corpus, the presumption of innocence and the rule of law. Most important, we need to reclaim our honor.

Big changes are coming for the dollar; it’s just a matter of whether we allow those changes to bog us down in recriminations and pessimism or use them to create a new vision of America and restore the principles of republican government. It’s up to us.